In what ways‚Äč does the Central Bank of Libya ‚ÄĆstabilize the economy during periods of conflict and ‚Ā§economic‚Ā£ turmoil?

The Crucial Role of Libya’s‚ÄĆ Central Bank in ‚ÄčShaping Politics and Business

Libya’s Central ‚ĀĘBank,‚ĀĘ officially known ‚Äčas ‚Äčthe Central Bank of Libya ‚Äč(CBL), plays a vital role‚ÄĆ in‚Ā£ shaping the political ‚ĀĘand ‚ÄĆbusiness landscape of the country. As the primary monetary‚Äč authority, the central bank is responsible for implementing monetary policy, regulating the banking sector, managing the country’s foreign exchange ‚Äćreserves, and ensuring price stability. In ‚Äčthis article, we ‚ÄĆwill explore the key functions of Libya’s Central Bank and its impact‚Äč on politics ‚Ā£and business in the country.

Functions of Libya’s Central ‚ÄĆBank

The Central Bank ‚Äčof Libya is entrusted with several important functions that are essential for maintaining‚ĀĘ the stability of the ‚Äćcountry’s ‚Äćeconomy. These functions include:

- Monetary Policy: The central‚ĀĘ bank formulates and implements monetary policy to control the supply of money‚ĀĘ in the‚Ā£ economy, regulate interest rates, and manage inflation.

- Banking ‚ÄĆRegulation: The CBL‚Äć regulates and ‚Äćsupervises the banking sector to ensure ‚ĀĘthe safety and soundness of financial institutions, protect depositors’ funds, and maintain ‚Ā§financial‚ÄĆ stability.

- Foreign Exchange‚Äč Management: The central bank manages Libya’s foreign ‚Ā§exchange‚ÄĆ reserves ‚Äčand oversees the‚Äč country’s foreign exchange market to support the stability of the national currency.

- Issuance of ‚ÄĆCurrency: The‚Ā£ CBL ‚Ā§has the sole ‚Ā£authority to issue and regulate the ‚Ā§circulation‚Ā§ of Libyan currency, including banknotes and coins.

Impact on Politics

The Central Bank of Libya‚Ā£ wields significant influence in the country’s ‚Ā£political landscape due to its control over monetary policy and foreign exchange reserves. Its decisions and‚Äć actions‚Ā§ can‚ÄĆ have far-reaching implications ‚Ā£for ‚Äčgovernment finances,‚ĀĘ economic ‚Ā§development, and social welfare. The central bank’s role in ‚ĀĘpolitics includes:

- Government Financing: The CBL plays a key role‚Äć in financing the‚Ā§ government’s budget deficit through the purchase of treasury securities, which affects the ‚Ā§government’s ability ‚Äćto fund public ‚ÄĆservices, infrastructure projects, and social welfare programs.

- Stabilizing the Economy: By implementing monetary ‚Äčpolicy measures, such as ‚Äčadjusting interest rates and managing currency exchange rates,‚ÄĆ the central ‚Äćbank can contribute to ‚ĀĘstabilizing the economy and mitigating the impact of economic shocks.

- Influencing Policy‚ĀĘ Decisions: The central bank’s advice and recommendations are often sought by ‚Ā§policymakers on matters related to fiscal and monetary policies, exchange rate management, and economic reforms.

Impact on Business

Libya’s Central Bank also exerts a significant impact on the country’s business environment, financial markets, ‚Ā§and private sector activities. Its‚Ā§ policies and regulations ‚ĀĘinfluence‚Ā£ the behavior of businesses, investors, and consumers in various ‚ĀĘways, including:

- Banking Sector Stability:‚Äč The CBL’s oversight of the banking industry ensures the stability and integrity of financial‚Äč institutions, which ‚Ā£is‚Äč crucial for‚Äč fostering confidence and trust in the banking system.

- Credit Availability: The central bank’s‚Äč monetary policy‚ÄĆ decisions, particularly ‚Ā§concerning interest rates and‚ÄĆ reserve requirements, affect the availability and ‚ÄĆcost of ‚Ā£credit for businesses and individuals, which in turn influences investment and consumption decisions.

- Exchange Rate Volatility: The central ‚Ā£bank’s management of foreign exchange reserves and currency ‚Äćexchange rates can impact the competitiveness of ‚Äćbusinesses engaged‚Äć in international trade and influence the prices of imported‚Äć goods and services.

Case Studies

An illustrative example of‚Ā§ the significant role‚Ā§ played by Libya’s Central‚ÄĆ Bank in shaping politics and business can be seen in its response to the challenges arising from the country’s political instability and civil unrest. During‚ÄĆ periods of conflict and economic turmoil, the central bank‚Ā§ has‚Äć implemented measures to ‚Ā£stabilize the financial system, support essential‚Ā£ public services,‚Äć and‚ĀĘ preserve the value of the national currency.

Firsthand‚Ā£ Experience

As a‚ÄĆ business owner ‚Ā§or ‚ĀĘinvestor operating in Libya,‚Ā£ it is essential ‚ÄĆto have a comprehensive understanding of the central bank’s policies, regulations,‚Ā§ and economic outlook. ‚ĀĘThis knowledge can help in making informed decisions‚Äć regarding capital allocation, risk management, and strategic planning. Engaging with the central bank and staying informed about its announcements and reports can provide valuable‚ĀĘ insights into the prevailing economic conditions and ‚ÄĆthe potential impact‚Ā£ on business operations.

Benefits and Practical Tips

Understanding the crucial role of Libya’s Central Bank can provide several‚Ā§ benefits to businesses,‚Äć policymakers, and the general public:

- Enhanced‚ĀĘ Risk Management: By monitoring the central bank’s policies and economic indicators, businesses can better anticipate‚Äč and mitigate ‚Äćrisks arising from changes in monetary‚ĀĘ conditions‚Äč and‚ÄĆ market ‚Ā£dynamics.

- Informed Decision ‚ÄćMaking: Access to ‚Ā£reliable ‚Ā£information and analysis from the central bank can empower policymakers and business leaders to make informed decisions regarding financial planning, investment strategies, and‚Äć economic reforms.

- Promoting Economic Stability: Collaborating with the central bank and supporting its initiatives for promoting financial inclusion, regulatory compliance, and sustainable economic growth can contribute to‚Ā§ the overall stability and prosperity of the country.

Conclusion

Libya’s Central Bank plays a crucial role in shaping the country’s politics ‚ĀĘand business environment through its monetary policy, banking regulation, and foreign exchange management. Its influence extends to government financing, economic‚ĀĘ stability, and business operations, making it‚ĀĘ an indispensable‚Äć institution for driving sustainable ‚Äćeconomic ‚Äčdevelopment and prosperity. By understanding the central bank’s functions and impact, ‚ÄĆbusinesses and policymakers can navigate the complexities of the Libyan‚Äć economy and contribute to its growth and resilience.

Impact‚ÄĆ of Leadership Dispute on Oil Production in ‚Ā£Libya

The recent‚Ā§ leadership dispute between rival governments in Libya has led to‚Ā£ the suspension of oil production ‚Äčin ‚Äćthe ‚Ā§country.‚ĀĘ At the center of this conflict is ‚Ā£the control of Libya‚Äôs‚ĀĘ central bank, which oversees billions of dollars in oil revenue. The governor of the bank has‚Ā£ fled the country out of fear for‚Ā£ his life, highlighting the severity of the situation.

For‚Äć the‚Ā§ past decade, two rival governments have been vying for power, influence, and control over Libya‚Äôs ‚ĀĘextensive oil reserves. This power struggle has created instability and uncertainty ‚ĀĘwithin the country. This week, the internationally ‚Ā£recognized government in ‚Ā§the west‚Ā£ made the decision to‚Äč replace the central bank ‚ÄĆgovernor, a move that was met with resistance from the administration in the east, which ‚Äčoperates ‚Äčthe majority of the oil ‚Äčfields. As a result of this ‚Ā£dispute, oil production‚ÄĆ has been halted.

The ‚ĀĘimplications of this feud are far-reaching and could have‚Äč a significant impact on‚Ā£ the Libyan economy. The country heavily relies on oil revenue, and any disruption in production can lead to economic downturn. Furthermore, this conflict raises‚Äć concerns ‚Ā£about the potential resurgence of civil war ‚Äćin Libya.

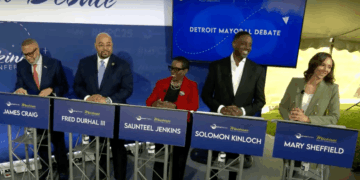

To gain insight into the ‚Ā£situation, we turn to our‚ĀĘ panel ‚Ā§of experts: Faraj Najem, a historian and political researcher;‚Äć Claudia ‚Ā£Gazzini, a senior‚ÄĆ Libya analyst at the International Crisis Group;‚Ā£ and Mustafa Fetouri, an independent Libyan academic. Their diverse perspectives provide valuable insights into the complexities ‚Ā£of the leadership dispute and its potential consequences.

As the situation continues to unfold, the international‚Äć community closely monitors the developments in Libya, hoping for a resolution that will bring stability and prosperity to the‚Äč country.